Aligning our investments with our Values

As a Certified Financial Educator (CFEI) and Money Coach, my goal is to EMPOWER individuals to make their money grow holistically. I believe one of the ways we can achieve this is by aligning our investments strategies with our VALUES. And that my friends, is the beauty of Sustainable Investing!

Sustainable Investing allows us to put our money into companies that meet particular ethical, social, and environmental practices. It includes an investment strategy following 3 main pillars: ESG, SRI, and Impact Investing.

Let’s break it down:

ESG stands for Environmental, Social, and Governance. If you invest using this strategy, it usually means that you invest in companies that INCLUDE certain ESG friendly characteristics & practices. For instance, they are companies that care about their impact on the environment (carbon emissions/green energy), on society (community outreach programs), on employees (labor practices), and even on the characteristics of their leadership (board diversity & ethical business practices).

SRI stands for Socially Responsible Investing (although some market participants refer to it as Sustainable, Responsible, and Impact investing). This strategy usually focuses on EXCLUDING certain types of industries or companies that may not be in alignment with investor’s ethical standards. For instance, it could exclude firms that produce firearms or other weapons, oil and gas, or tobacco & include firms that have positive sustainable impact, such as solar energy companies.

Impact Investing is a strategy focused on investing in companies in the private sector – example into small businesses. However, it also includes public investments that focus on certain themes and have a positive impact on the environment & society.

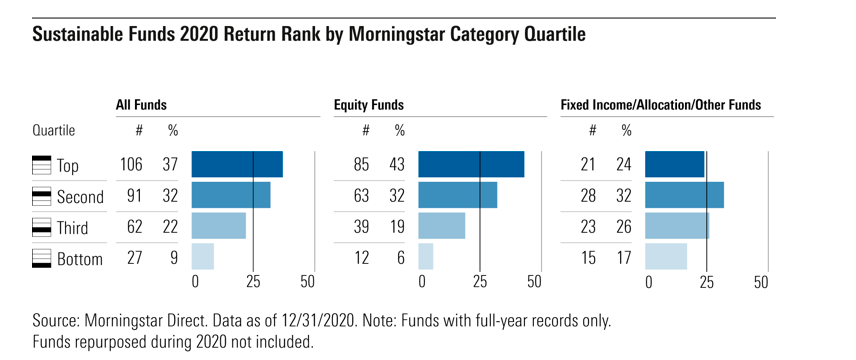

According to research by Morningstar’s John Hale, sustainable funds outperformed conventional fund peers in 2020 – most especially equity funds. In fact, 43% of sustainable funds posted returns in the top-quartile. That’s pretty cool! So, not only are we aligning our investments with our VALUES but also making our MONEY GROW.

So, how do you invest in this space?

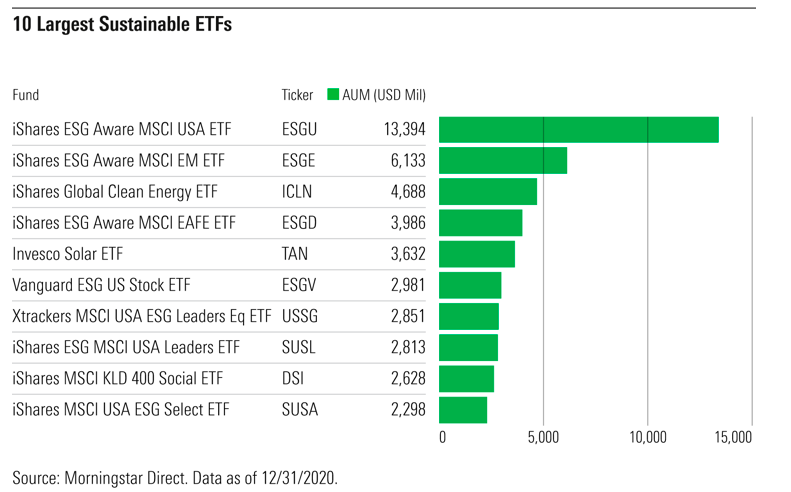

There are various ways. You can do it yourself (DIY) by choosing individual companies or alternatively pick Funds and/or ETFs that focus on this ethos (they can be actively or passively managed, include equities or fixed income bonds, and be domestic or internationally focused). Or, you can invest via your current pension/retirement provider and/or brokerage who may have ready-made ESG friendly alternatives for you to choose from. You can check this online (logging into your account) or speaking with them directly (don’t be shy).

If you are new to the investment space, you can also consider a robo-advisor (online investment platforms that use algorithms & automation to help you choose the best investments in alignment with your risk tolerance), as many of them also offer socially responsible options. Examples of robo-advisors include Betterment, Wealthfront, Ellevest, Nutmeg, Moneybox, Wealthify, and EToro. And a note to my UK friends, you can even invest in ESG ISAs! That’s right. So, make sure to contact your ISA provider with further questions.

Finally, when investing ALWAYS remember to do your research! Make sure you understand what you want to invest in (for instance do you want to avoid certain companies or industries), understand the underlying investments in an ETF or FUND, know the fees (expense ratios), and look up their ratings (I love Morningstar for this).

If you found this post helpful, please share with others & if YOU want to start your journey to Financial Health & Abundance, then book a FREE 20min Discovery Call with me via https://wearyourmoneycrown.com/book-a-call.

And friends, always remember to Wear Your Money Crown & Rule Your Finances!

Xoxo,

Anna

Subscribe to our email list for future financial news, helpful tips, and updates, please do so today using this link https://successful-composer-5444.ck.page/ac0d024952.

JOIN our Free Facebook Financial Community at https://www.facebook.com/groups/wearyourmoneycrown.

Any questions regarding this post, please email us at info@wearyourmoneycrown.com.