Confusing signals everywhere

January has been a pretty surprisingly strong month for the Stock Market & I wanted to share some thoughts…because let’s be honest, with all the negative economic sentiment and talks of a “recession” out there (both in the USA & UK), it can be VERY confusing!

On one hand it’s all “doom and gloom” and on the other it’s “where’s the party at?!?”

You know what I mean?

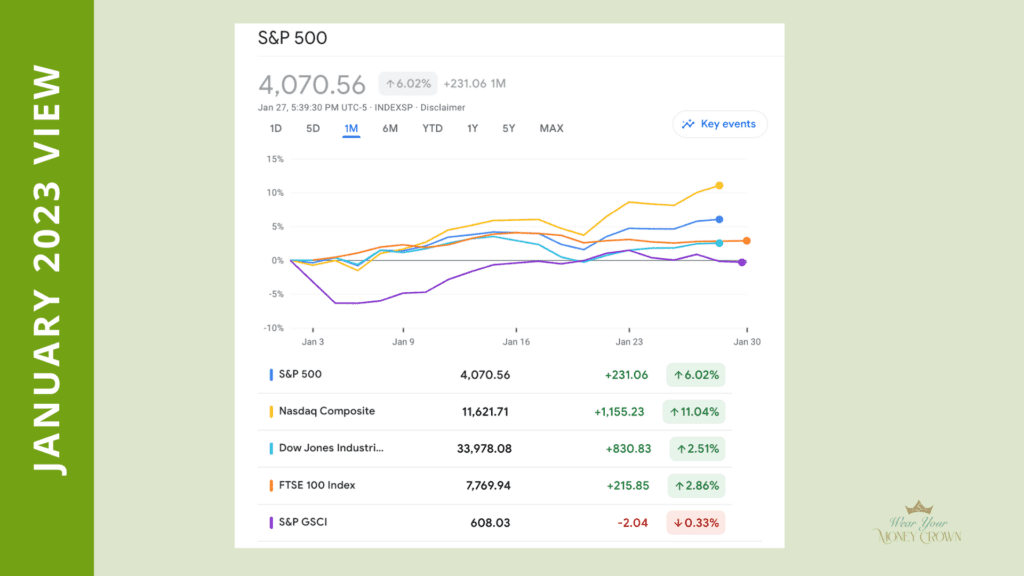

As the image below shows, some of the major stock market indices in the USA and UK performed nicely at the start of 2023 (data is as of 27th of January).

FYI – the S&P GSCI is a commodities index (they are down so far this month however I’m still conscious that Russia/Ukraine conflict is far from done so happy to have commodity exposure this year).

This the thing…

Despite the performance so far this year, we have to be mindful that there are some Negative Forces at play:

- Yield Curve Inversion – This means that shorter-date govie bonds are paying you more than long-term bonds…this is NOT normal. In fact, an inverted yield curve has emerged roughly a year before ALL recessions since 1960.

- Savings Rates are contracting and Debt levels are increasing – One of the positive phenomenons from the global lockdowns was the fact that household savings increased (of course this was NOT the case for everyone). Now, things are starting to shift as stimulus checks, unemployment benefits, and other policies put in place to lift economies have slowed down.

- Cooling down in consumer demand & Increase in job layoffs – Just in the last weeks, more than 68,000 layoffs have been reported across the tech sector & more are expected!

- Falling leading economic indicators – Remember the Conference Board’s Leading Economic Index is a barometer of the health of an economy. This index has now fallen 10 months in a row.

- Corporate Earnings pressures – 69% of S&P 500 companies have reported a positive EPS surprise in Q4’2022 vs the 5-year average of 77%.

THAT SAID, it doesn’t mean that markets will fall massively (although today has been a weak day), but I am treading carefully at the moment.

I’m also making sure to stay DIVERSIFIED from geographic exposure, as well as asset classes & sectors.

🚨Because with so many confusing signals, we have to BE ALERT as investors!

🗓 Regarding this week, I wanted to highlight a couple of IMPORTANT events to be looking out for as well…

Number One:

📌 THE FED (USA Central bank) meets this week to decide if they will raise rates again. Remember, as investors – no matter where we live – we need to follow what is going in the USA markets, as it influences other markets.

Economist’s consensus is for The Fed to raise base rates by 25bp. No problem there…

What we REALLY need to pay attention to is to the language of Chairman Powell and what he thinks going forward (out on Wednesday 1st of Feb).

➡️ Remember, if rates continue to rise and end up hurting consumers’ pockets further…that is NOT good for stocks.

Number Two:

📌 This is a BIG Earnings Week (Q4’2022 earnings) with tech heavyweights like AMAZON, APPLE, ALPHABET, and META to report.

And if you want to TRACK corporate earnings yourself, a super easy & free website to use is YAHOO FINANCE!

What’s really cool is that you can see what the market expects (EPS estimate) vs Reported and understand how the earnings end up vs the expectation. You can also filter by country. So, check it out if you want to actively follow the companies that you invest in.

That’s it for now, friends!

Have questions? Reach out to us below.

XOXO,

Anna

📌 NEED HELP? If you need a helping hand on your journey to financial wellness, don’t hesitate any longer and BOOK a Free 20min Discovery Call to see how we can help you! Remember, you must take ACTION to transform your financial life.

💌 SUBSCRIBE to our email list for future financial news, helpful tips, and updates, please do so today using this link https://successful-composer-5444.ck.page/ac0d024952.

🤗 JOIN Our Free Facebook Financial Community HERE.

Any questions regarding this post, please email us at info@wearyourmoneycrown.com