Aligning Aspirations with Financial Realities

In 2005, Steve Jobs gave a memorable commencement speech at Stanford University. He famously advised graduates to “follow your heart.”

His exact words were:

Your time is limited, so don’t waste it living someone else’s life. Don’t be trapped by dogma – which is living with the results of other people’s thinking. Don’t let the noise of others’ opinions drown out your own inner voice. And most important, have the courage to follow your heart and intuition.

Steve Jobs

Oh boy, do I LOVE this speech for SO many reasons!

However, as a financial educator and coach who works with individuals of all ages, including university students and adults looking to pivot their careers, I want to share some important thoughts…

Yes, I do believe in following your heart and intuition; after all, life is short. But I ask you to reframe this notion in a strategic way, particularly when you consider the cost of higher education in today’s world.

This is the thing…

Choosing a major or a new career path is a HUGE decision, particularly with the rising costs of higher education.

That’s why it’s essential to consider the real cost of following your dream, whether right out of college or when switching careers.

Let me share a bit of my story…

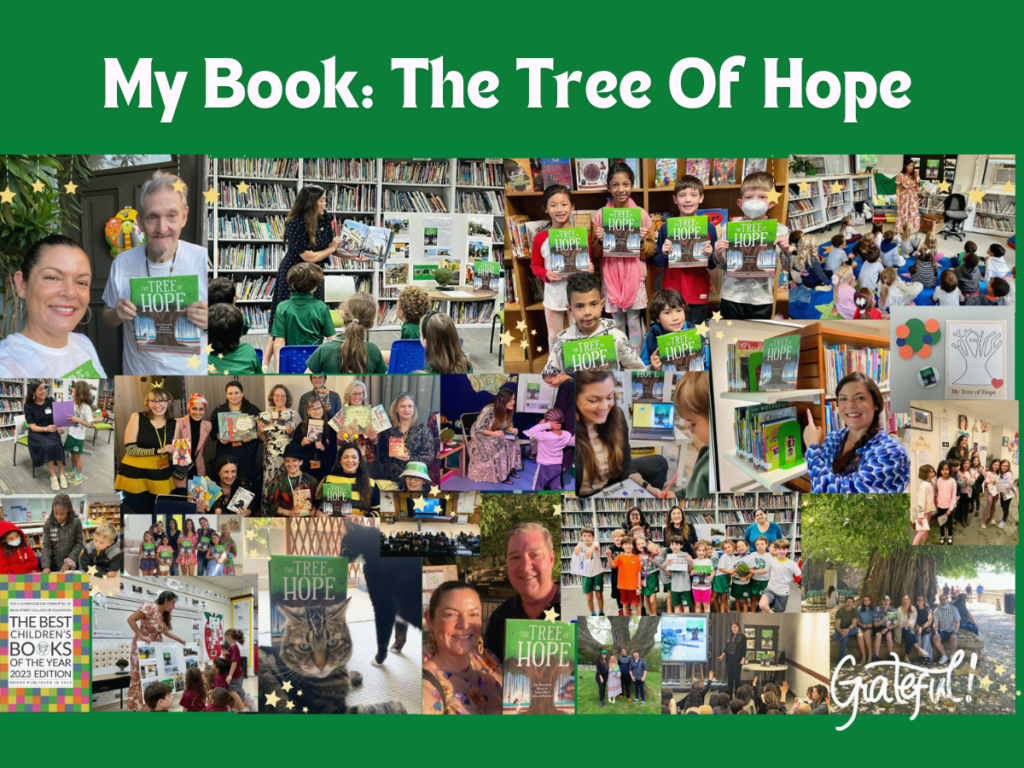

I am a creative at heart and have always loved writing. However, I realized that pursuing those passions right away wouldn’t provide for my family and dreams.

So, I chose a path that allowed me to build a solid financial foundation first. This decision eventually gave me the freedom to leave my career and focus on my true passions: teaching financial literacy, empowering individuals on their financial journey, and becoming a published author.

Yes, it took time, but it has 100% been worth it! 🚀

💡 TWO HELPFUL TIPS:

1️⃣ EVALUATE YOUR POTENTIAL EARNINGS:

Compare the minimum wage earnings to what your degree or new career path might bring. This can help you understand the financial viability of your choices.

2️⃣ ANALYZE YOUR CURRENT EXPENSES:

Don’t forget to account for your existing expenses, including educational loan repayments. This will give you a clearer picture of your financial situation.

Yes, the numbers can be startling! But remember, friends, there are seasons both in life and in our finances.

So, choose a path that allows you to build a solid foundation to pursue your true dream when you’re ready.

I would love to hear your thoughts on this topic. How do you balance following your dreams with financial stability? Reply to this email and let’s chat!

XOXO,

Anna

Ready to step into your financial power?

Explore our website to discover how we can collaborate, or get in touch directly HERE. For additional details, please see the information provided below.

Anna Orenstein-Cardona is a Financial Coach and NFEC-Certified Financial Educator (CFEI) who empowers organizations, small-business owners, and individuals to grow their money knowledge in fun and creative ways. She worked on Wall Street and in the City of London for over two-decades, before launching her financial education and coaching business, Wear Your Money Crown®.

When you’re ready to embark on the journey to financial empowerment, build generational wealth, and transform your financial future, consider these powerful avenues:

💰 INDIVIDUALS:

🚀 BOOK a Free 20min Zoom Discovery Call Dive deeper into our financial coaching and expertise. Explore how our tailored solutions, whether through one-on-one coaching, VIP sessions, or group coaching, can align with your unique needs. BOOK HERE.

📣 SIGN UP for Rule Your Finances™ Academy Waiting List Be among the first to know when enrollment re-opens for our transformative online course & group coaching program. SIGN UP HERE.

🌟 SCHOOLS AND ORGANIZATIONS:

EMPOWER Your Community We extend our financial wellness solutions to Educational Institutions & Corporates. Discover how we can equip your employees or students with the tools and knowledge they need to THRIVE. Interested? Simply BOOK A FREE CONSULTATION to learn more!