Understanding the blocks that can impede our financial success!

A significant barrier to financial empowerment is often rooted in what can be termed as “uncertainty” or “analysis” paralysis. Many times, this occurs when underlying fears and doubts prevent us from taking necessary financial actions, also known as financial procrastination.

For instance, you might feel that you lack the proper financial knowledge to make informed decisions, leading to the fear of making a wrong move. Consequently, you end up holding yourself back.

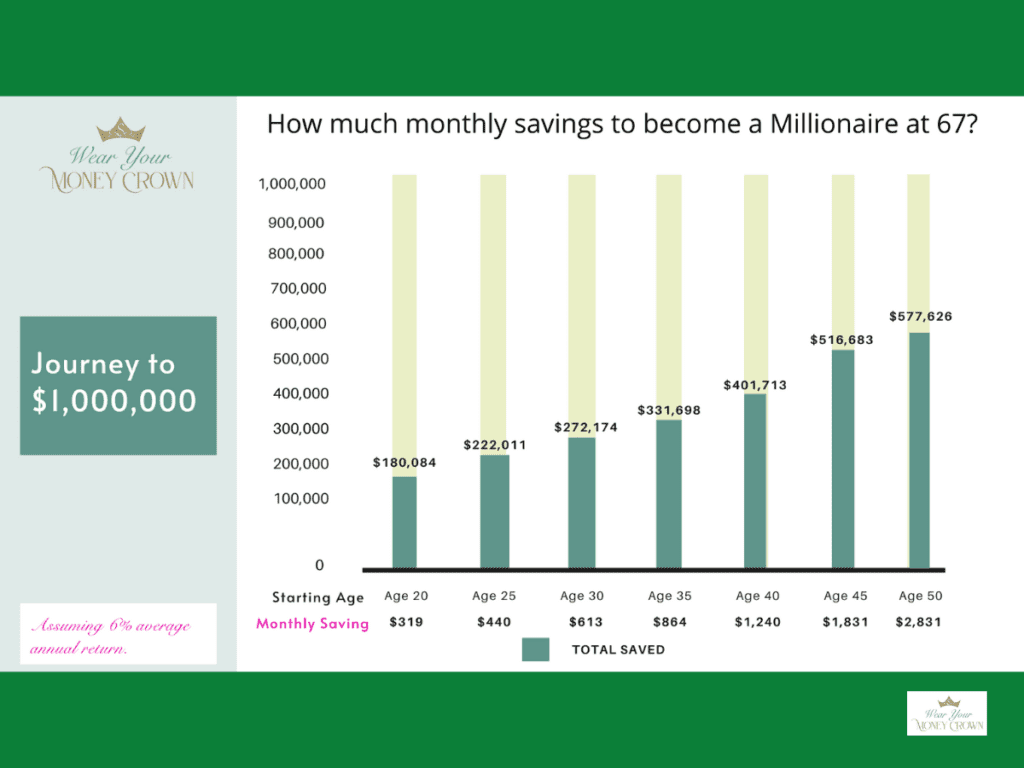

The issue with this hesitation is that wealth building relies heavily on the core pillars of time and compounding interest. As the below image shows, the earlier we save, the more our money can grow for us.

In reality, every day spent in the fear of ambiguity and inaction is time that your money is not working for you. It’s not just a missed opportunity for building wealth; the hesitation also adds to stress and anxiety, compounding the problem.

To break free from financial procrastination, it’s essential to confront the underlying causes directly.

In today’s blog, we are going to dive into the TOP 5 BLOCKS that can impede our financial success! By understanding these barriers & roots of financial procrastination, we can develop strategies to overcome them and move towards financial empowerment.

SELF DOUBT & FEAR THE UNKOWN:

One of the most common reasons for financial procrastination is self-doubt and fear of the unknown. Whether it’s starting an investment, budgeting, investing tax-efficiently, or planning for retirement, the lack of knowledge can be paralyzing.

The key is to start small and gradually increase your understanding. Just like you did when learning to ride a bicycle or driving a car!

Begin with the financial basics around cash flow management, budgeting, and investing. Also, seek out reliable resources and don’t be afraid to seek help from a professional.

INVESTING IN HELP:

Individuals often seek my help to transform their financial lives, yet sometimes I encounter those who hesitate to invest in themselves to achieve their goals.

My fees reflect my expertise as a financial professional and my mastery in strategizing and thinking outside the box. With over two decades of experience, I bring not only knowledge but the nuanced skills needed to build wealth and a diverse portfolio. My superpower lies in understanding each client’s unique needs and guiding them toward lasting success.

Here’s some ❤️ tough love: Investing in a professional or coach – an experienced professional – to move you forward should NOT be seen as an expense, but an investment.

Why?

Because quality professionals like me don’t just teach you; they show you how to THINK differently. This knowledge can be used in many practical ways to create further returns on investment (ROIs) in your life.

When I look at my most successful clients, they are the ones who don’t just invest in my services—they roll up their sleeves and dive in with full commitment. These are the clients who embrace the journey, who take each step I teach them with determination and grit.

They don’t just listen; they act. They don’t just learn; they transform.

As a result, they see a multiplication in the return on their investment, impacting their wealth-building journey and various aspects of their life. From refining their LinkedIn profiles to stand out, building the financial confidence to ask for raises, enhancing their thought leadership, improving personal and household finances, forming stronger bonds with their partners, and as entrepreneurs, valuing their services more and securing solid contracts.

The way I educate my clients is like planting seeds that will flourish and bear fruit in every aspect of their lives. This is not just about money; it’s about empowerment, confidence, and creating a future where YOU are in control.

Imagine transforming your financial life so profoundly that every decision you make radiates confidence and clarity.

I’ve lived this transformation myself by investing tens of thousands in professionals and coaches who have not only benefited my business but have empowered me to pass this invaluable knowledge on to you.

PERFECTIONISM

Many people procrastinate because they want to get everything perfect from the start. But here’s the truth: financial management is a journey, not a one-time event.

When you let go of the need for perfection, you open yourself up to growth, resilience, and true transformation.

It’s about progress, not perfection. Every misstep is an opportunity to learn, adapt, and move closer to the financial freedom you deserve.

So, embrace the journey with all its ups and downs. Commit to taking consistent action, after all progress is what leads to success!

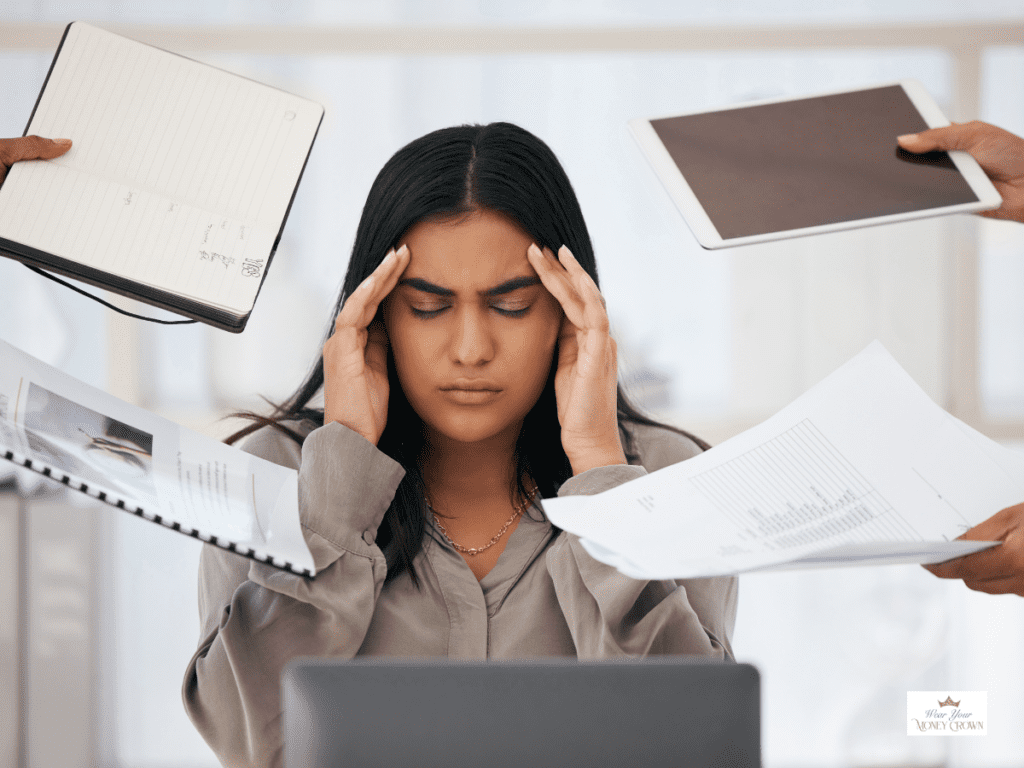

OVERWHELM

The sheer amount of financial information and tasks can be overwhelming! There’s SO much “noise” out there, and frankly, as an educator and coach, I can tell you that much of it is not useful.

In fact, a lot of it is just crap. Many strategies are merely copy-paste advice from well-known financiers like Warren Buffett, but they come from people who have little experience in building true wealth and a poor depth of knowledge.

So, focus on the music, not the noise!

To cut through the clutter, break down your financial goals into smaller, manageable steps. Remember, it’s not about doing everything at once; it’s about taking one step at a time, consistently moving forward.

Prioritize what matters most and tackle one task at a time. This approach makes the process less daunting and more achievable.

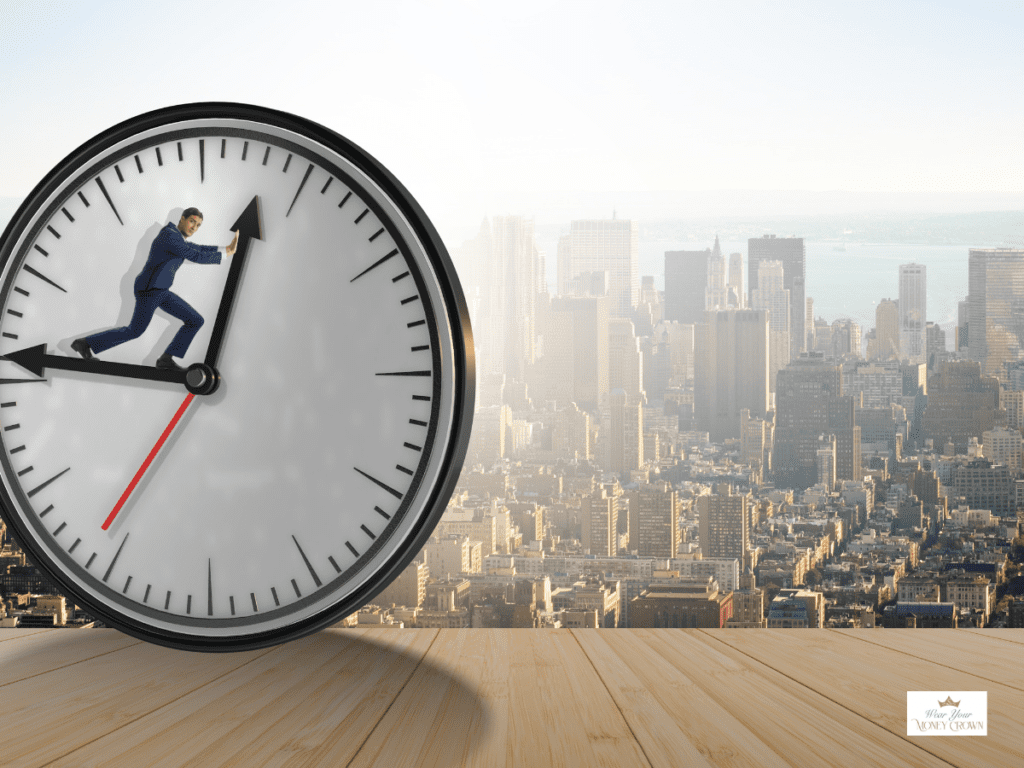

LACK OF IMMEDIATE GRATIFICATION

Unlike other activities that provide immediate rewards, financial management often requires patience and long-term thinking. It can be challenging to stay motivated when the fruits of your efforts seem distant.

To combat this, picture yourself achieving short-term goals that give you a sense of accomplishment and fuel your drive to keep going. These milestones act as stepping stones, guiding you steadily towards your ultimate financial objectives.

Embrace the power of patience and the motivation that comes from achieving short-term goals. Stay focused, stay motivated, and watch as your financial dreams become a reality, one milestone at a time.

…

Friends, hope you have found this helpful! And stay tuned, as next week, I will share the top 6 strategies to help you overcome financial procrastination!

Xoxo,

Anna

Ready to step into your financial power?

Explore our website to discover how we can collaborate, or get in touch directly HERE. For additional details, please see the information provided below.

Anna Orenstein-Cardona is a Financial Coach and NFEC-Certified Financial Educator (CFEI) who empowers organizations, small-business owners, and individuals to grow their money knowledge in fun and creative ways. She worked on Wall Street and in the City of London for over two-decades, before launching her financial education and coaching business, Wear Your Money Crown®.

When you’re ready to embark on the journey to financial empowerment, build generational wealth, and transform your financial future, consider these powerful avenues:

INDIVIDUALS:

➡️ BOOK a Free 20min Zoom Discovery Call: Dive deeper into our financial coaching and expertise. Explore how our tailored solutions, whether through one-on-one coaching, VIP sessions, or group coaching, can align with your unique needs. BOOK HERE.

➡️ SIGN UP for Rule Your Finances™ Academy Waiting List: Be among the first to know when enrollment re-opens for our transformative online course & group coaching program. SIGN UP HERE.

SCHOOLS AND ORGANIZATIONS:

🌟 EMPOWER Your Community: We extend our financial wellness solutions to Educational Institutions & Corporates. Discover how we can equip your employees or students with the tools and knowledge they need to THRIVE. Interested? Simply BOOK A FREE CONSULTATION to learn more!