As a female financial educator and wealth coach, I’ve heard from several clients and readers who are feeling uneasy, confused, and yes—even a little overwhelmed by what’s going on in the financial markets right now.

If that’s you, take a breath. You’re not alone.

Stock markets have always had a bit of a flair for drama. And when the headlines scream, the numbers drop, and the energy shifts, it’s completely natural to feel unsettled. This moment feels noisy, chaotic, and—let’s be honest—a little discouraging.

So, I want to take a moment to break things down. Not just from the lens of an educator and wealth coach, but as someone who deeply understands that money is emotional. It’s personal. It shapes our security, our freedom, and our vision for the future.

Let’s Talk About the VIX (a.k.a. the “Fear Gauge”)

You may have seen me mention the VIX index before—it’s often called the “fear gauge” because it measures expected short-term market volatility. And yes, it spiked again recently.

But it’s not just the number that spiked. You can feel the anxiety, too.

This time, the volatility is largely being driven by last week’s shocking tariffs—calculated in a way that has left many economic experts scratching their heads.

Even some of Wall Street’s most seasoned voices (including former Trump supporters) have raised red flags. Billionaire investor Bill Ackman, for example, didn’t mince words:

“We are in the process of destroying confidence in our country, as a trading partner, as a place to do business, and as a market to invest capital.”

What This Means for Everyday Investors:

It means we breathe. We zoom out. And we remember our why.

This is exactly why we:

➡️ Build our knowledge before putting our money to work.

➡️ Optimize our savings strategy and secure our short-term money in liquid accounts, not tied up in the market.

➡️ Diversify our investments across asset classes, industries, and geographies.

➡️ Avoid chasing trends.

➡️ It’s why we invest with a long-term lens, grounded in strategy and NOT fear.

As Warren Buffett famously said:

“Be fearful when others are greedy and greedy when others are fearful.”

Right now? Fear is LOUD!

But fear isn’t a strategy.

What I’m Doing With My Own Portfolio

Back in early March, I shared with my email subscribers that I had already begun making some intentional changes in my portfolio.

I wrote:

“I’m actively cutting loose investments I no longer believe in, while seizing opportunities to buy high-quality stocks at a discount and DIVERSIFYING where it makes sense. I’m unmarrying stocks and investments that no longer serve me (Goodbye, Adiós, Auf Widersehen). It’s not easy—trust me, I get it. But we’ve got to put emotions aside and make smart, strategic moves.”

That still holds true.

In light of the latest volatility, I’m continuing to put money to work—strategically. I’m focusing on resilient, high-quality companies with solid fundamentals that I’d be proud to hold over the long term.

And yes, I’l well aware that stocks could easily fall further.

But that’s okay.

Why? Because I’m investing thoughtfully, in increments, across different days and months. That way, I average out my cost and stay aligned with my long-term plan.

🙋🏻♀️ How I Move In Times Like This:

When it comes to investing, I’ve been doing this a long time….well over 20 years, before becoming a female financial educator and wealth coach. And below, are a few nuggets of wisdom that I put into action.

They really help me get through these intense times, like these!

- Not letting market noise disrupt my inner peace

- Not trying to chase the “bottom”

- Staying grounded in fundamentals and trusting what I know to be true

- Supporting my clients with clarity, confidence, and care

- Sharing my knowledge so others can feel informed, empowered, and less alone in uncertain times

A BIG PICTURE PERSPECTIVE:

Yes, the recent drop in stocks has largely reflected economic fundamentals. The fear? That continued tariffs could trigger a slowdown in global trade, reducing productivity and profits across industries.

But here’s something important to remember:

Markets Are Emotional Too!

And in times like these, history becomes a powerful teacher.

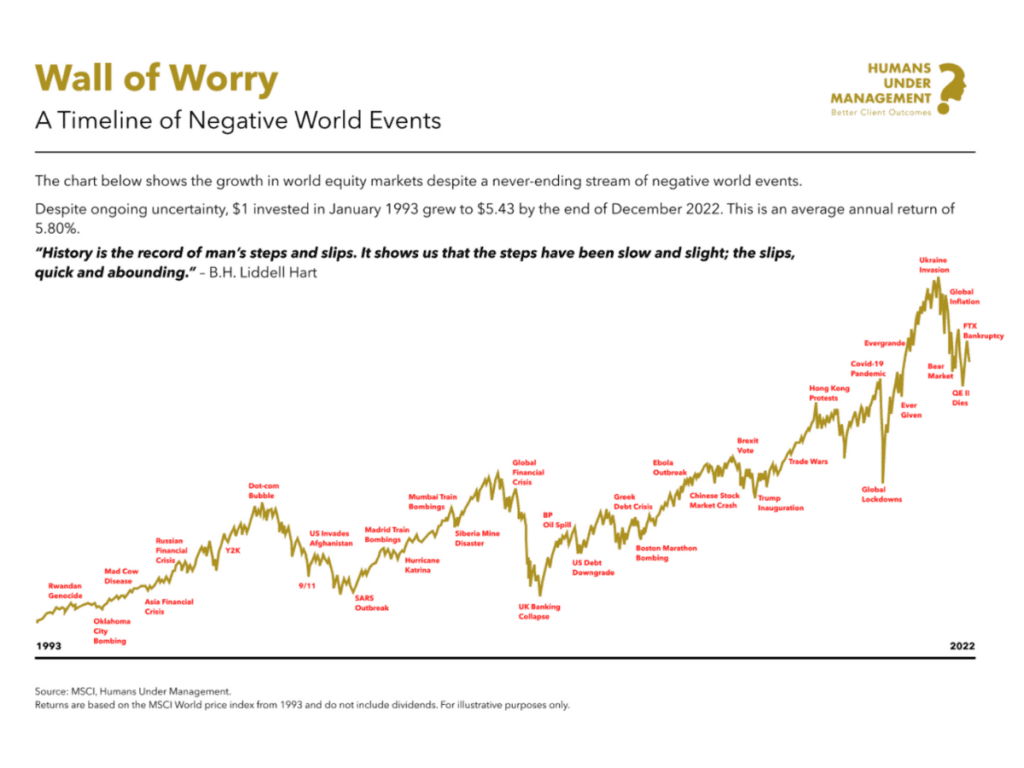

👉🏽 The graph below, which was recently highlighted by Robert Ross from Tikstocks, tells a powerful story: through wars, recessions, pandemics, and political upheaval, world equity markets have still trended upward, rewarding those who stay the course.

FOOD FOR THOUGHT:

I don’t have a crystal ball 🔮.

But this I know, if we get a signal of easing, whether from leadership walking back policies or central banks stepping in to stabilize things, MARKETS could potentially rebound quickly.

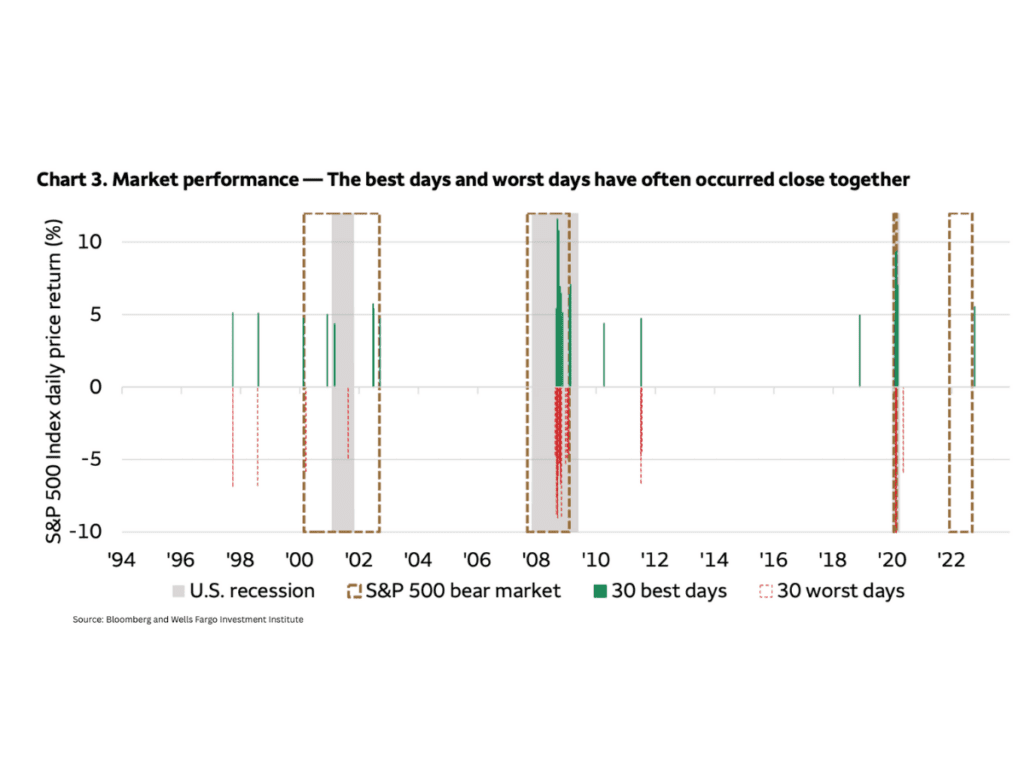

In fact, history shows that after large drops, some of the biggest gains often follow closely behind.

⬇️ That’s exactly what the graph below highlights—from 1994 to 2022, many of the market’s best days happened right after some of its worst.

In Case You Missed It: Our MasterClass

We dove into all this – and more – in last week’s MasterClass on Investing through volatility, emotional resilience, and long-term strategy.

So, if you missed it and want to watch the 7-day replay, you can grab it HERE. It’s packed with strategy, perspective, and mindset tools to help you move forward with clarity.

…

Let’s wrap up with a gentle reminder:

Investing is a marathon, not a sprint. Don’t let fear take the wheel. Stay diversified. Stay focused. Stay curious.

👑 Your Money Crown is forged not just in the wins, but in how you hold steady through the storms.

With heart,

Anna

Ready to step into your financial power?

Explore our website to discover how we can collaborate, or get in touch directly HERE. For additional details, please see the information provided below.

Anna Orenstein-Cardona is a Financial Coach and NFEC-Certified Financial Educator (CFEI) who empowers organizations, small-business owners, and individuals to grow their money knowledge in fun and creative ways. She worked on Wall Street and in the City of London for over two-decades, before launching her financial education and coaching business, Wear Your Money Crown®.

When you’re ready to embark on the journey to financial empowerment, build generational wealth, and transform your financial future, consider these powerful avenues:

➡️ INDIVIDUALS:

BOOK a Free 20min Zoom Discovery Call: Dive deeper into our financial coaching and expertise. Explore how our tailored solutions, whether through one-on-one coaching, VIP sessions, or group coaching, can align with your unique needs. BOOK HERE.

SIGN UP for Rule Your Finances™ Academy Waiting List: Be among the first to know when enrollment re-opens for our transformative online course & group coaching program. SIGN UP HERE.

➡️ SCHOOLS AND ORGANIZATIONS:

EMPOWER Your Community: We extend our financial wellness solutions to Educational Institutions & Corporates. Discover how we can equip your employees or students with the tools and knowledge they need to THRIVE. Interested? Simply BOOK A FREE CONSULTATION to learn more!